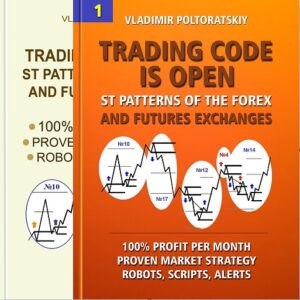

ST PATTERNS TRADING SYSTEM OF THE FOREX, FUTURES AND OTHER LIQUID MARKETS

The trading system presented in this book, based on Structural Target Patterns (ST Patterns), is able to bring an average monthly profit of about 100% or more of the deposit amount. You can get such results with liquid exchange instruments, such as currency pairs (EUR/USD, GBP/USD, AUD/USD) or futures for commodities and indices.

CONTENTS

About the author

Opportunities for using ST Patterns

Forex and Futures markets

The fundamentals of the Trading System

Conditions for constructing the ST Patterns

Starting ST Patterns

Initial ST Patterns

Completion ST Patterns

The starting point for ST Patterns

Unfavorable periods in the markets

Charts EUR/USD, Copper, SP500 index

ST Patterns schematics

Famous graphic models and ST patterns

Emotions and discipline

Robots, Scripts and Alerts

Conclusion

Contact

ABOUT THE AUTHOR

I have worked as a trader for about 20 years. Disappointed with the effectiveness of most well-known trading methods, I have developed a new trading system based on Structural Target Patterns (ST Patterns™). Over the years, I have distilled a complex analysis of markets movements into a clear and simple system of decision-making.

To prepare for writing this book, I carefully refined my trading system built on graphic ST Patterns until it I felt that it had no gaps. A substantial history of graphical analysis proves this method’s practical effectiveness in the Futures and Forex markets. For me, the question of how to trade profitably has gone through both theoretical and practical phases, eventually turning into an ordinary craft.

There are significant differences between the classical graphic models and ST Patterns. The Structural Target Patterns presented in this book reflect the majority of market movements and give the trader unambiguous signals to action. In addition, ST Patterns are almost always present in the market and consist of market charts.

OPPORTUNITIES FOR USING ST PATTERNS

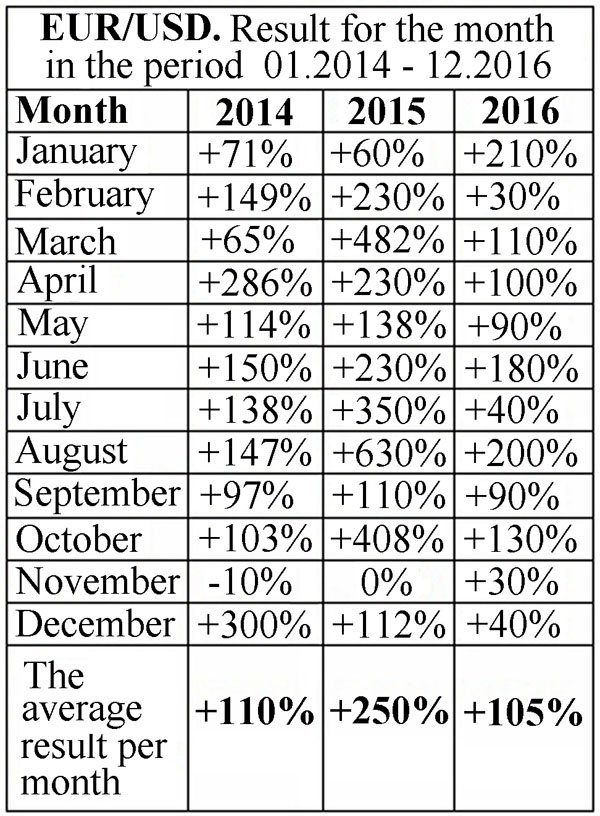

The table in Figure 1 shows a possible yield on EUR/USD trading for the past three years.

Fig. 1: Results on EUR/USD pair for the past three years

The results were obtained from hourly charts and rounded to integers. So, in a given year, one or two months can experience a small, zero, or negative return. The maximum loss for a single month in EUR/USD occurred in November 2014 and amounted to 10% of the deposit. However, December of that year provided a profit of +300%, generously compensating for that loss.

For more stable monthly results, you can work simultaneously on two or three trading instruments. For example, calculations of monthly profitability working with GBP/USD and AUD/USD for 2016 are shown in Figure 2.

Figure 2: Results on GBP/USD and AUD/USD for 2016

The presented results were obtained without taking into account the impact of a great deal of important economic news on trade. A trading robot could obtain this profit at this point in time, if it was working without errors. If, on the other hand, you exclude unprofitable trades done due to lack of consideration for important economic news, the result could be much better!

These calculations assumed that the profit received at the end of the month would be withdrawn from the trading account. Therefore, a trading system built on a compound progression could give a fantastic annual result!

Profitable Trading System

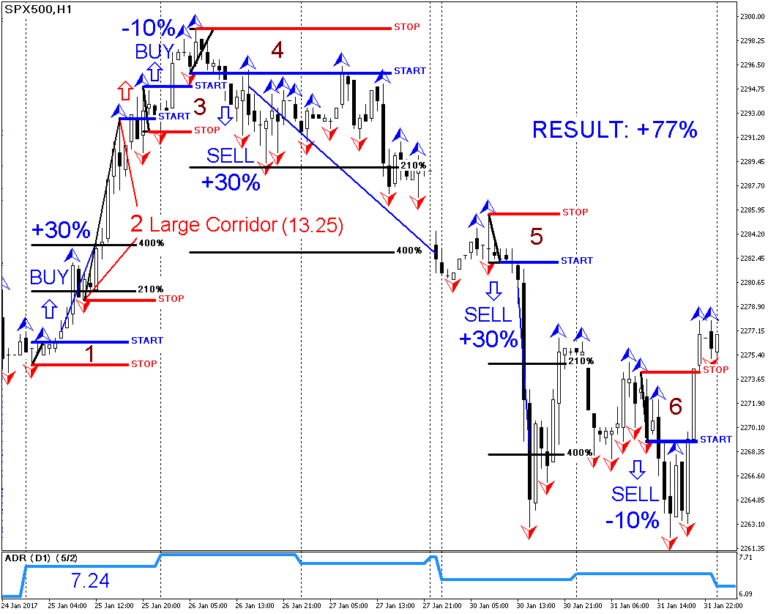

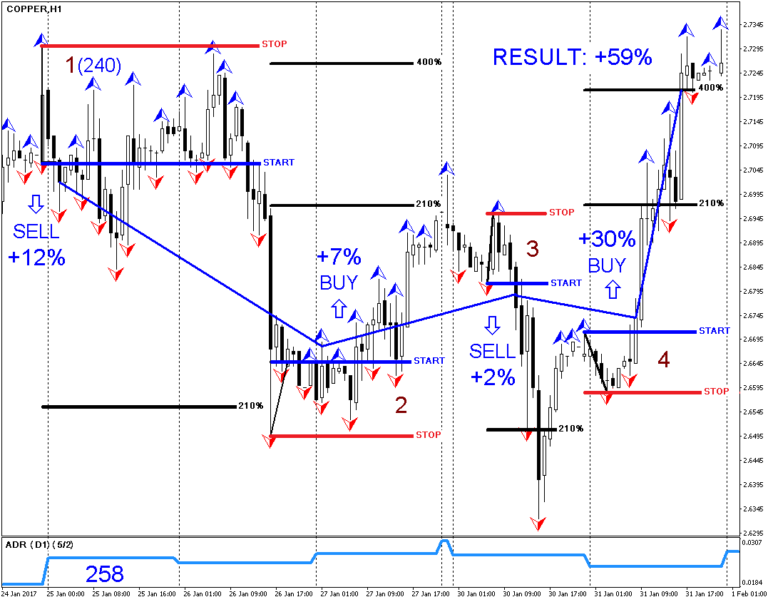

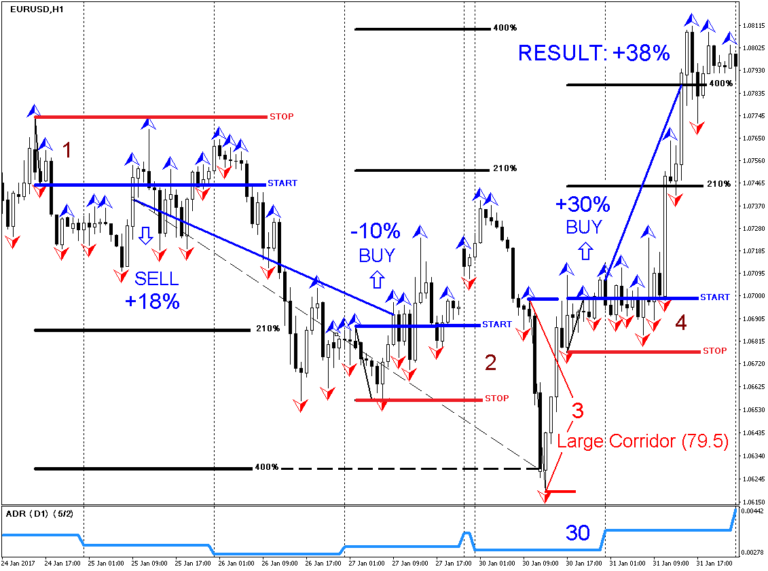

As of the writing of this book it is the beginning of February 2017. Figures 3, 4 and 5 show market charts for the last working week of January 2017. As an example demonstrating the possibilities of the trading system based on ST Patterns, futures were taken for the S&P 500 Index, copper futures and the EUR/USD currency pair.

Figure 3: S&P 500 futures index over the last five days in January 2017

Figure 4: Commodity market of copper for the last five days of January 2017

Fig. 5: Price chart for the currency pair EUR/USD over the last six days in January 2017

For a few days of work, a trader could earn about 77% on the S&P 500 index. Copper futures would bring about 59% in profit, while trading in the EUR/USD pair could add about 38% to the amount in the account. After the trading system based on the ST patterns is thoroughly dissected and explained, I will once again present these three graphs with a detailed contextual description. Thus, using the information published in this book, any trader can learn to see the exchange opportunities presented here, independently.

Periods of Uncertainty

There are sometimes periods of uncertainty that arise in the market. So, the exact plan of action during unfavorable periods is one of the most important components of any successful trading strategy. The advice I give for this system is to simply avoid those periods. Although ST Patterns give unambiguous trading signals in volatile markets, I’ve found that profitability is increased by sitting out known high impact news events.

The trading of the EUR/USD currency pair is the main example in this book. But, the algorithm for these trades, detailed—for the first time ever—in this book, is also applicable to other liquid currency pairs and futures exchanges...August 2019.

You can buy this book on Amazon and Smashwords

The month following the first book’s «Trading Code is Open» publication perfectly demonstrated the possibilities of using the trading system. It showed how almost half of the ST Patterns published in this book operate in practice. The technical analysis presented in «Forex Strategy: ST Patterns Trading Manual, EUR/USD Chart Analysis Step by Step, 300% for One Month» book, based on accurate calculations, will help traders consolidate the acquired knowledge, and to increase their own skills with Structural Target Patterns. In addition, the study of the GBP/USD pair will help readers understand the importance of determining periods of market uncertainty in a timely fashion.